Anyone with an interest in luxury watches, such as those produced by Rolex, Audemars Piguet and Patek Philippe, knows to expect to have to pay high prices for the top brands. However, one of the noticeable trends throughout 2020 and 2021 has been a rapid increase in prices, even above what you might typically anticipate.

Therefore, if you are getting into the watch market yourself in 2021 or 2022, or looking to purchase a luxury timepiece for a friend or loved one, you are likely to have plenty of questions regarding the prices you see. Why are these watches so expensive? Why are watches selling way above retail price? Should you try to buy on the grey market?

In this article, we explore the answers to these questions and more, and outline what is behind prices skyrocketing.

The Issue of Supply and Demand

One of the reasons why luxury watches are typically so expensive is because the supply of many timepieces does not come close to matching the demand. In other words, there are more people who want to buy luxury watches than there are luxury watches on sale. This can lead to situations where customers enter Rolex retailers to see very few watches to no watches on sale and it is common to find that you are unable to actually purchase a watch you may have seen on their website.

Brands like Audemars Piguet and Patek Philippe make even fewer watches than Rolex. Some have even accused these brands of intentionally cutting supply to drive prices up, but in reality, their strategy is about keeping the value of their products high by retaining a sense of exclusivity. By contrast, anyone with enough disposable income can get hold of an Omega timepiece fairly easily, because the quantity of watches they place on the market is simply higher.

In fact, AP, Patek and similar brands sometimes release new watch lines in such limited numbers that there may only be 300 timepieces for a specific model on the market. While this does help to provide these watches with an exclusive, luxury appeal, it does little to detract from feelings of disappointment caused by empty watch displays at your nearest Authorized Dealer, or only seeing models you are not interested in. This then leads us on to our next point.

Unfair Package Deals and Scalpers

Another issue that has caused luxury watch prices to increase has been the rise of unfair package deals. So what does this actually mean? Put simply, it is a concept which forces buyers to purchase a timepiece that is nowhere close to what they want, in order to get a chance to buy the watch model they do want.

The way this usually works is Authorized Dealers will insist that you become a customer first, before you are deemed eligible for their list for the most desirable watch models. Examples of watches that might be sold under this scheme include Rolex Daytona, Patek Philippe Nautilus and Audemars Piguet Royal Oak models.

Of course, “become a customer” in this context means you will need to purchase one of their less desirable timepieces, at full retail price, and this may even be significantly above the true market value of the watch. For instance, you could buy a watch like the AP Code 11.59 or around $35-40k (as of August, 2021) on the grey market, but it retails for around $50k.

Even after this, you will often have to wait for the watch you do want. Then, once it becomes available, it might not necessarily have the dial color you wanted, or may not even be made from the material you wanted. So, to offer an example, if you wanted a Royal Oak 41mm Stainless Steel Chronograph watch with a silver dial, you would likely have to purchase a less desirable watch to become a customer, then wait for the watch to become available – which could take years – and even then, you may need to compromise on the dial color, or the case material.

Unfortunately, this is the reality of dealing with many Authorized Dealers and they know they can continue this practice, because they get requests for their most popular watches every day, at a pace that far outmatches the stock they actually have available. Often, the only way to deal with these sellers is to establish a “relationship”.

Yet, in truth, the “relationships” they build with customers are completely unfair. You are effectively assisting their business by helping them to shift less desirable timepieces, all for the vague opportunity to one day gain access to a watch that may or may not be the exact model you are looking for. Authorized Dealers argue that these relationships are necessary to prevent scalpers from buying luxury watches, and it is certainly true that scalpers are a contributing factor. Nevertheless, the end result is a system that continually penalizes honest customers.

COVID-19 and the Pandemic Effect

Another interesting factor for buyers to be aware of has been the impact of the COVID-19 pandemic on the luxury watch market. While conventional wisdom may have led people to believe that lock downs and reduced time spent in physical workplaces, or on nights out, would lead to reduced demand for luxury watches, this does not appear to have been the case at all. In fact, brands like Rolex and Patek Philippe saw significant spikes in demand for certain models.

In particular, there have been spikes in demand for entry-level, stainless steel models, but these are not the only watches that have been impacted by the so-called ‘pandemic effect’. So what is driving this demand?

One possible explanation is the fact that the pandemic meant people were spending less of their money on other luxuries. Traveling abroad became difficult or even impossible, many flights were grounded, a large number of entertainment venues were closed and people generally spent more time at home, rather than doing the things they normally would. The end result of this was a lot of people having more money to spend on luxury items, like watches.

Additionally, manufacturers may have found it harder to produce new watches during the pandemic, leading to lower levels. One thing we do know is that when products become difficult to get hold of, they also become more desirable.

Resellers and Grey Market Dealers

Resellers have also contributed to skyrocketing luxury watch prices and this also ties in with grey market dealers, including Jaztime. One way that resellers with a lot of money to spend have increased prices is by purchasing packages from Authorized Dealers, which may include several less desirable luxury watches, in order to gain access to the more desirable models, such as Audemars Piguet Royal Oak, Rolex sports, or Patek Philippe Nautilus.

Typically, these resellers will then sell the less desirable watches for a very small profit, or perhaps even at a loss, while selling the more desirable watches at a substantial premium. This then results in a situation where the reseller makes a healthy profit, the Authorized Dealer gets rid of undesirable watches and those buying the more desirable watches from the reseller at a premium are able to skip the long waiting lists.

Another similar pattern that often occurs is as follows: a buyer is fortunate enough to get a desirable watch for retail price from an Authorized Dealer. They then discover that, due to limited stock and high demand, the watch is selling for almost twice what they paid for it on the open market. They may then sell the watch to a grey market dealer, such as Jaztime. They make a profit, the grey market dealer acquires a watch to sell, and a new buyer then pays a premium to buy it from the grey market dealer, without having to spend considerable time on a waiting list.

Dealing With Long Waiting Lists

Whether you are required to form a relationship with them by buying other watches or not, the reality is that buying the most popular luxury watches from Authorized Dealers goes hand-in-hand with a long waiting list. If you want a unique skeleton dial Audemars Piguet, you will almost certainly have to wait. If you are looking for a Rolex Daytona, you are going to be waiting years. These long waiting lists have also contributed to rising prices.

The reality is, many customers do not want to wait years for their watch and they will instead pay a premium on the grey market to gain access to a watch faster. This means even used watches sell for extremely high prices if the model is in demand and if the waiting list for the model is long. Remember, you are essentially paying extra to skip the queue.

So why do these waiting lists exist and why won’t your nearest Authorized Dealer sell you the watch you want now?

1. The Authorized Dealer does not have control over supply. The truth is, they are essentially powerless when it comes to whether they have a particular watch in stock or not. If the watch manufacturer is releasing the model in limited supply, the dealer is going to have to wait for watches to come in and this can take a long time.

2. There may be people with larger wallets than you, who have already spent large amounts of money buying watches from that dealer, and the dealer may be prioritizing them over you for this reason.

3. Your Authorized Dealer suspects you are a scalper or flipper, rather than a true collector. There are many ways an AD can build up a picture of a customer, based on communication. However, even beyond this, an AD can tell if you have previously sold certain watches on the grey market, due to the warranty cards. Audemars Piguet watches, for example, can be registered to a new owner, so the original dealer will know when the watch has changed hands. Some ADs also use secret shoppers to help identify scalpers and flippers.

If an Authorized Dealer believes you are in this category, they may not offer high-value or desirable timepieces to you, but they may still take money for less desirable ones, under the guise of building a relationship.

The Role of Investors, Speculators, & “Store of Value”

Some of the other groups of people who have played a role in increasing luxury watch prices are investors and speculators. Broadly speaking, investors can be described as people who purchase luxury watches with a view to making a long-term profit. They will make strategic watch purchases, thinking about the models that are most likely to gain value over time, and they may hold onto the watches for years before eventually selling them for a profit. Of course, in the meantime, they are taking watches out of circulation and adding to their value in the process.

Speculators, on the other hand, make up a small but significant part of the grey market. They adopt a much more short-term approach, flipping watches very quickly. Their approach is sometimes described as looking for ‘The Greater Fool’, with this being the person who will buy a watch tomorrow for significantly more than the speculator bought it for today. Again, this process means watches are being taken out of circulation, and it also means that people are purchasing watches at a high price, which then raises free market value.

Similar to the idea of buying gold and silver, watches are also a “Store of Value”. Gold and silver have no actual purpose to an average person as you can’t just wear a block of either material. Currently we are in a time of general instability; Covid-19, inflation, and stock markets all having wild symptoms on the economy, people are looking towards finding things that hold their value over time. Rather than just hording money into a bank account or the stock market, many people buy these watches as a way of storing their money while simultaneously enjoying its beauty, wearing it, and possibly even selling it for a profit later on. It easily beats money sitting in the bank and in most cases beats the S&P and the NASDAQ index.

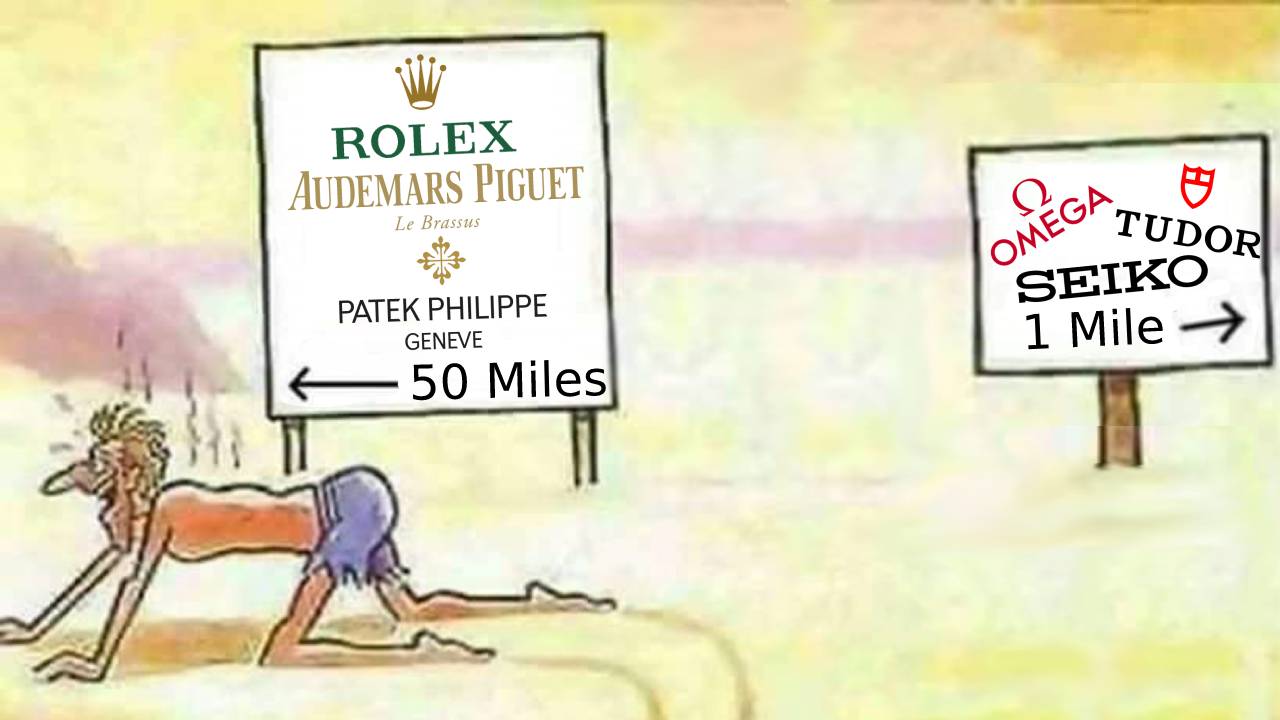

Market Prices – Buying From Jaztime

All of this also ties in with us here at Jaztime.com too. If you are looking for a timepiece and you need it quickly, you can pay the market price, skip those long waiting lists and get your watch when you want it.

So what do we mean by the market price? As we are a grey market luxury watch dealer, we sell our timepieces at the best possible price we can offer you, based on free market prices at the time of your purchase. The exact price will depend on a range of factors, including the number of watches we have in stock. However, we always do our best to make sure our prices are fair and up to date as no transaction will occur until the final dollar amount is agreed upon.

Do you need a Rolex Submariner on your wrist as soon as possible? Are you hoping to get hold of your favorite Audemars Piguet? Buy from Jaztime.com and you can make that dream a reality today.

Final Thoughts – What Should I Do?

The price of luxury watches has increased over the course of 2020 and 2021, with a variety of different factors influencing these price rises, including the COVID-19 pandemic, limited watch availability and increased demand for the most desirable models. All of this begs the question: what should you actually do about it?

The first main option is to take your chances with an Authorized Dealer, pay the retail price, and accept that you may face significant waiting times and unfair package deals, as outlined. Alternatively, you can pay the market price on the grey market, buy from a reliable seller, like Jaztime.com, and get your luxury watch much quicker.